Brim Open Rewards is a new loyalty platform that is changing the Canadian landscape by opening up how you earn your points and where you can redeem your points. We looked at the existing loyalty structures in Canada today and found that they were too stale, too constrictive, and too unfair. So, we’ve put Canadians back in control of their points.

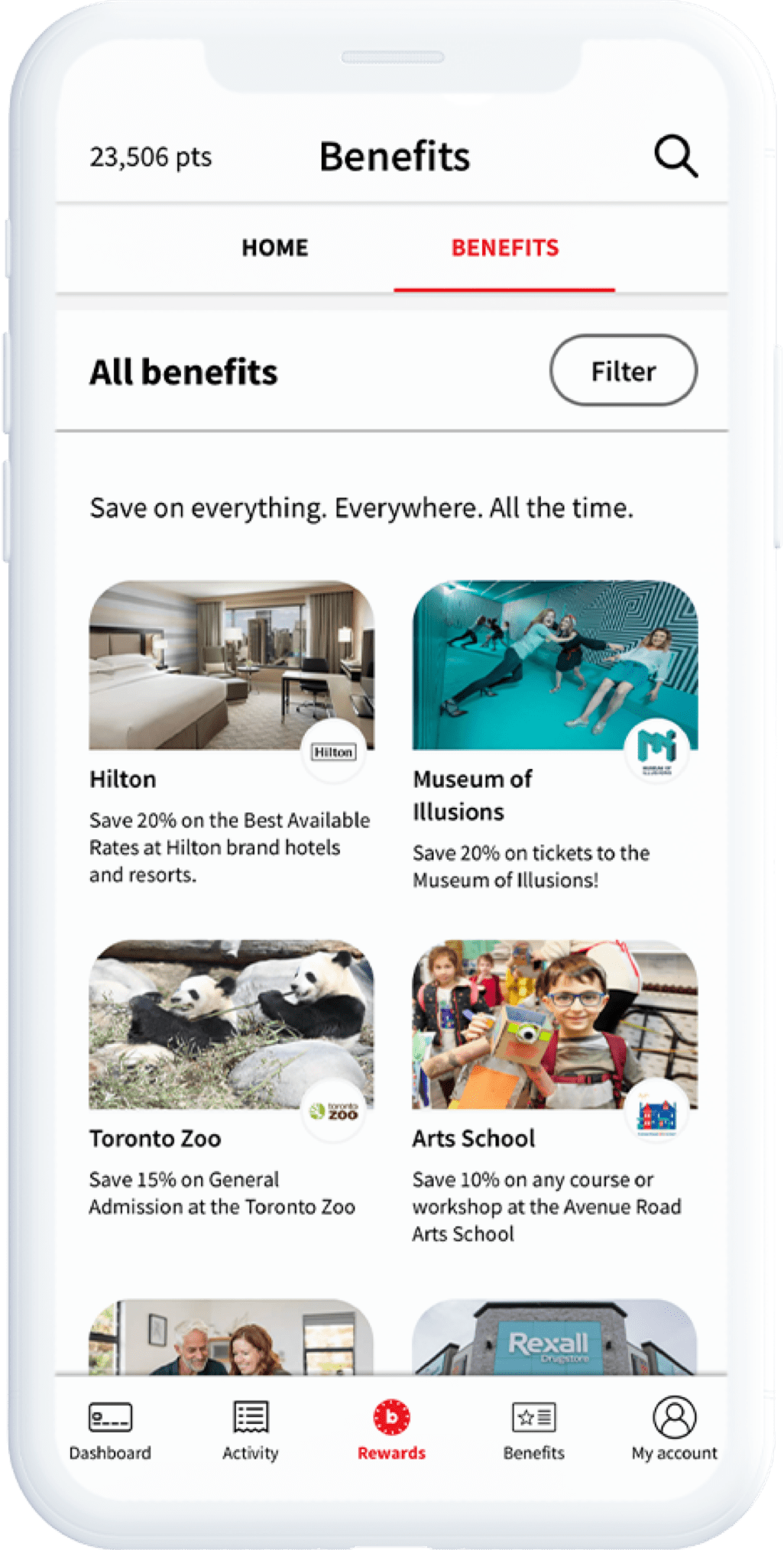

Brim is the first credit card loyalty program in Canada to allow you to redeem on any purchase at anytime, anywhere that Mastercard is accepted. While other loyalty programs restrict your ability to redeem, whether that’s on very specific travel options, at specific grocery stores, or as cashback at the end of the month or year, Brim does the opposite: Brim allows you to redeem for groceries, travel, a new computer, or even for your morning coffee. You can also redeem your available points as cashback at any time against your statement balance.

You no longer have to choose between a travel card, a grocery card, or a cashback card – it’s all in one.

We’ve put you in control of your points to do with them as you wish.

Brim also opens up how you earn your points. In a traditional loyalty program, you would earn 1.5% or 2% on very specific categories, such as Groceries or Gas, and then 1% on everything else. But what about your morning coffee? Or your lunch spot? Or your annual Netflix subscription? Why aren’t you rewarded for your continued loyalty? Why do you earn the same number of points as the guy who’ll never shop there again?

Brim has said goodbye to stale categories. While you continue to earn your base rate on all of your purchases sometimes we’ll replace it with something even better: you can take advantage of accelerated earn offers the more you shop at participating retailers – restaurants, coffee shops, travel and more. As an example, you could earn 2 points on every $1 spent on your first visit, 4 points for every $1 spent on your third visit, and 10 points for every $1 spent on your 6th visit. You can browse all available offers and track what level of earn you’re at on the Brim Marketplace – in the Brim Portal and App.

Absolutely. Instead of redeeming against a specific transaction, pay your balance directly with your earned and available points. This can be done at any time against your statement balance, not just at year end like traditional cashback platforms. It’s a more convenient and flexible method of cashback – and who doesn’t love that?

Points are earned on a per transaction basis, as long as your account is in good standing. Zoomer+ cards have base earns, but what’s unique about the earn rates on our loyalty platform is that you can take advantage of accelerating step up earn offers at participating retailers. The more you shop at their stores, the more the earn rate per dollar spent increases. In essence, it’s rewarding you for your loyalty with merchants that have accelerated earn offers with Zoomer+. All available offers can be viewed in the Brim Marketplace, both in the Zoomer+ Portal or mobile app.

It’s the bread and butter of Brim Open Rewards! Think of it as an open Marketplace, where retailers are bidding on your business by offering special increased earn offers, accelerated step up offers the more you shop at their stores, and redemption multipliers so that you purchase and subsequently redeem at their stores for significant discounts. Brim Marketplace is fully interactive and allows you to filter and sort by category, location, trending, hot deals, online versus in-store, and so much more.

Nope! We do all the heavy lifting 💪. All you need to do is look at the Brim Marketplace for participating merchants and purchase the products or services you’d like with your Brim Card, online or in-store. We’ll capture everything on our side and even notify you by email or in-app notifications of your accelerated earn amount.

No way! Brim Open Rewards is uncapped and unlimited, which means you can continue to take advantage of all the offers available to you in the Brim Marketplace no matter how much you spend on your Brim Card.

Brim was founded on equitable values. No matter which card you have, all Brim members can take advantage of step up accelerator offers and redemption multipliers on the Brim Marketplace. The main difference between the cards is in your base earn value where there are no Brim Marketplace offers. Please see the card comparison chart for details on base earn for the three cards.

Brim will be offering earn multipliers at participating merchants. Double the points on purchases at Amazon.ca are limited to your first $10,000 in annual spend on Amazon (including taxes and delivery charges) and will return to your base earn thereafter.

You can redeem your points by clicking the “Redeem” button next to your transaction(s) in the Brim Portal. On the Brim App, just swipe left!

A redemption (burn) rate is the dollar amount that you can redeem a single point for. You may have recently heard this term because many Canadian financial institutions are shrinking their burn rate to reduce their outstanding loyalty commitments. This means that your points may have just lost up to 40% of their value! Plus, these notices are often hidden in the tiny fine print – so be sure to ask your financial institution if your points are still worth what they should be worth!

1 point = $0.01 when you redeem your points on a specific purchase and when you redeem your points as cashback towards your statement balance.

Points can be redeemed starting at $1.00 (100 points)! 🎉

Your points won’t expire for as long as your Brim account remains open and in good standing!

Advanced first-to-market features and continuous platform upgrades

Access over 1 million Boingo Wi-Fi hotspots in planes, airports, hotels and cafes around the world. Set up your free account and get started in seconds.

*Offer only available for Zoomer+ World Elite cardholders.

Free Global Wi-Fi offered by

Zoomer+’s Family Card allows you to set monthly spending limits for the additional cardmembers on your account. Perfect for monitoring purchasing and promoting smart spending.

You can add an additional cardmember to your account at time of application, activation or anytime thereafter in the Zoomer+ Portal or App.

You can set spending limits when you’re activating your Zoomer+ Card, or anytime thereafter in the Zoomer+ Portal or App. Spending limits can be set once we have created the account in our system, which typically takes a few days after adding an additional cardmember.

To remove a user from your account please contact our Member Services team.

From approval to having the new card in hand, it’ll take about 2-5 business days. ⚡

You’ll be able to see all the purchasing activity of your additional cardmembers in your Portal or App. You can also filter by additional cardmember to track purchasing an individual level. If you prefer to track their spending real-time, you can also set up purchase notifications via email or mobile push notification.

If you don’t set a spending limit, your additional cardmember’s card will act like a regular authorized user’s credit card. You can still take advantage of other Zoomer+ offerings like real-time purchase notifications.

All you have to do is pay your balance. Your outstanding balance reflects the sum of all transactions made with Zoomer+ cards tied to your account. If you set a monthly spending limit and one or more of your additional cardmembers require a higher limit, you can easily adjust their monthly limit in the Zoomer+ Portal or App.

1. Log in to your account on the Zoomer+ Portal or App

2. Visit the “My Account” page and select “My Cards”

3. Make your changes! 👍

Yes! All points earned accumulate to the primary cardmember’s account. Only the primary cardmember can redeem points.

Additional Cardmembers can enjoy a number of Brim perks. They have access to the Zoomer+ Portal and App, where they can easily track their monthly spend, set budget limits and have full access to the Brim Marketplace.

Additional Cardmembers are unable to make redemptions or set up installments.

$5,000,000 maximum coverage.

48 days MSRP; up to $85,000.

$2,000 insured, max value of $5,000 per trip.

Up to $1,500 for loss, theft or damange.

Up to 1 additional year, up to $25,000.

$2,500 per occurance.

Instantly lock your card and block online or foreign transactions. Unlock your card when you're ready to make a purchase again!

All in real-time. You're in control.

Know the moment your card is used to make a purchase. Never be left wondering if your card is being used fraudulently.

Instantly lock your card and block online or foreign transactions. Unlock your card when you're ready to make a purchase again!

All in real-time. You're in control.

Know the moment your card is used to make a purchase. Never be left wondering if your card is being used fraudulently.

Choose the card that's right for you